Socially Responsible Investing Definition • ESG • Performance • Shareholder Advocacy

Socially Responsible Investing (SRI) means different things to different people. For you, it could mean aligning your investments with your values. It could also mean investing in a portfolio of companies that meet a minimum standard of sustainability. At Hansen’s, our job is to help you determine what SRI means to you and create a portfolio that reflects your unique values.

Socially Responsible Investing (SRI) means different things to different people. For you, it could mean aligning your investments with your values. It could also mean investing in a portfolio of companies that meet a minimum standard of sustainability. At Hansen’s, our job is to help you determine what SRI means to you and create a portfolio that reflects your unique values.

SRI was initially used purely as an additional layer of analysis beyond just the traditional financial analysis. SRI provides a qualitative analysis of a company or an analysis of the quality of the company itself. This analysis allows us to mitigate the risk inside of a portfolio by ruling out companies that are inherently unsustainable, and therefore riskier, and to invest only in companies that meet a minimum standard of sustainability. Because the risk inside of socially responsible portfolios is reduced, they have historically outperformed traditional investment portfolios.

To determine which companies are socially responsible, analysts evaluate these companies using Environmental, Social, Governance criteria, or ESG.

Environmental, Social, Governance, or ESG, are the criteria that are used by financial analysts to determine how Socially Responsible a company is. For Environmental, companies are screened for their records on pollution, water usage, energy efficiency, and supply chain and product sourcing sustainability. Social refers to product safety and employee relations. More specifically, how well employees are treated, if they are paid a living wage, provided benefits, and can move up within the company. Governance, or Corporate Governance, evaluates executive compensation as well as board and corporate racial and gender diversity.

What Does This Mean For You?

At Hansen’s Advisory Services, we will sit down with you to determine what is important to you. Then, using ESG criteria and several other analytical tools, we create a portfolio that is reflective of your unique values. This portfolio is also developed in consideration of your risk tolerance and financial plan.

Once the portfolio is created, we will review our process with you, so that you fully understand what companies you are investing in, and how that relates to your overall financial plan. By investing in a socially responsible portfolio, you are not only investing according to your values, but you are well positioned to meet your financial goals, as these types of portfolios have historically outperformed traditional investing.

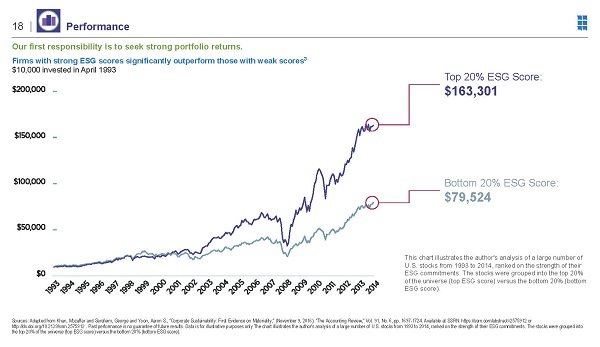

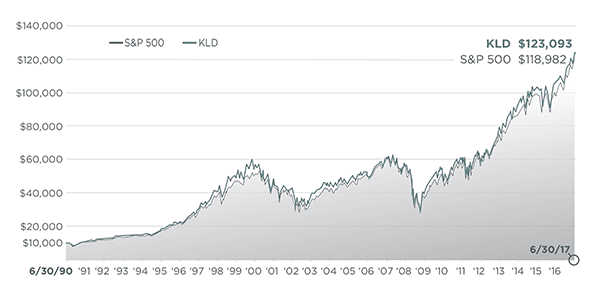

Socially Responsible Investing Performance

Research reports show that when companies score well on ESG criteria they may outperform ones that do not.

ESG ratings are based on the use of Environmental, Social and Governance criteria to manage risks within a portfolio.

The S&P 500 is an index made up of the largest 500 companies with the highest market value of the stocks listed on the US stock exchanges.

MSCI KLD 400 Social Index was launched in May 1990. This is one of the first Socially Responsible Investing (SRI) indexes. This index aims to select companies with the highest ESG ratings from the S&P 500 index.

Shareholder Advocacy

When you invest in a socially responsible portfolio, you are doing more than just aligning your investments with your values. Shareholder advocacy is a growing movement in the United States and around the world, enabling you to leverage your financial stake in a company to effect change. As a part owner of a publicly traded company, you have shareholder rights. These rights include filing shareholder resolutions, voting on resolutions, and directly engaging with the company.

At Hansen’s, our portfolios often consist of working with socially responsible money managers. If you invest in this type of portfolio, shareholder advocacy is done for you. They vote your shares using proxy voting, and they file resolutions and directly engage with the company on your behalf. Because the managers have a much larger stake in the company than an individual stockholder might, they are able to have a greater impact.

Shareholder advocacy has had a tremendous impact on companies all around the world on issues like climate change, women’s rights, clean water, employee rights, and racial and gender diversity. Money managers are well positioned to continue using these tools to address issues like the opioid epidemic and plastics pollution.

To find out the impact of your socially responsible investment, please contact us.